You loos your money if you have your money in saving account

What? How? The best saving rate today is like 0.5%. So if I have $10,000 then you will earn $50 a year so how that is loosing money?

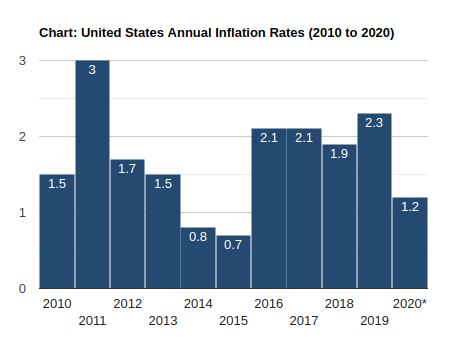

Because currency devalued over time (cause of an increase in the money supply is one of the biggest reason) and its rate is shown below:

You see no year has inflation rate below 0.5% thus you are loosing money although you maybe earning 0.5%.

So let’s make your money earn at the rate of higher than inflation rate

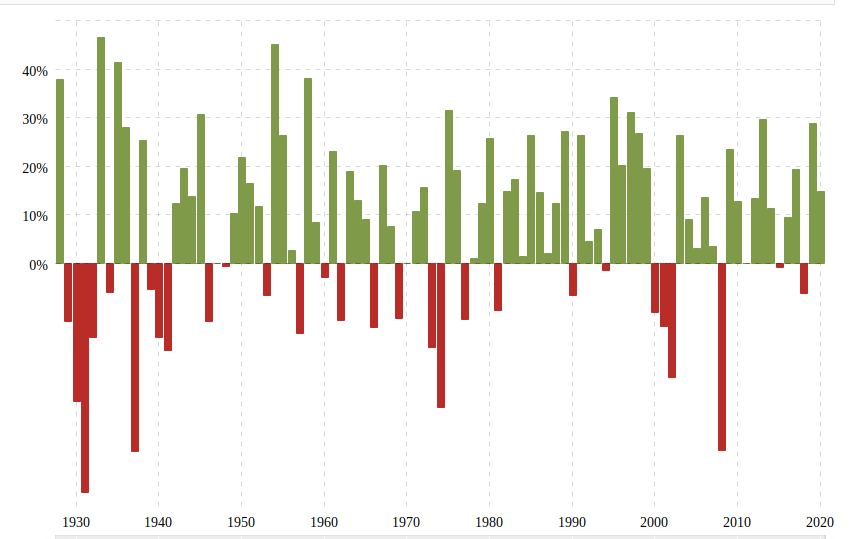

Below graph is showing historical S&P performance of last 90 years. There are bad years but eventually come back.

Historical Annual Returns

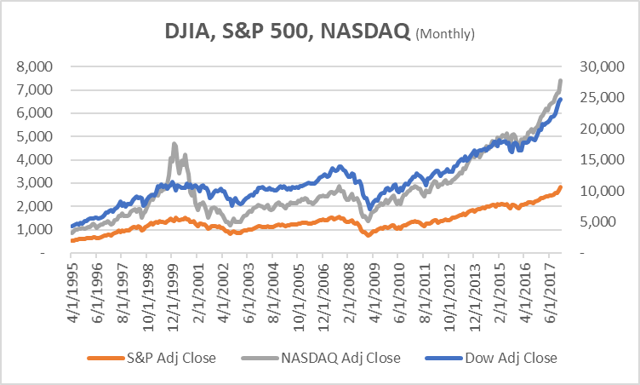

DJIA, S&P 500, NASDAQ

Do you feel safe to invest in S&P 500? If the answer is Yes, let’s move on to next section otherwise your money can stay in the Saving account.

Where do I start? What are the options?

You can start small. Like as little as $1!

There are mainly 2 types of investment method:

- Robo-Advisor Investing (Automated investment)

- Self Directed Investing (pick your own)

We do robo-advisor but still do self-directed because:

- We have self-directed accounts that are pre-dates Robo-Advisor investing

- It is fun to hand pick individual stocks for ones you believe in

Platforms

Here are some platforms and its features:

Robinhood

- no comission for self-directed investment

- no robo-advisor investing

SoFi

- no comission for self-directed investment

- no management fee for robo-advisor investing

- offsers Individual and IRA

- No *tax-loss harviesting

- Handle crypto investing

- 10 portfolios

- **Rebalancing (do not offer tax efficient porffolio)

Betterment

- 0.25% management fee for robo-advisor investing

- no self-directed investment

- Tax loss harvesting (annual benefit of 0.48%)

- Socially responsible investing

- Goal based investment strategy (we have sub-account like travel, big-purchase etc)

- 101 portfolios

- offsers Individual and IRA

- Smart rebalancing (tax efficient)

What do we use

Robinhood, Acorns and Betterment are the ones we use (addition to TD Ameritrade for legacy reason) but while I was writing this blog, I learned SoFi so just started.

- We maxmize 401K - if you can and haven’t done so, you should

- We use Robinhood for just have fun - buy individual stock for small amount of money. Moving $50 a month and buy favorite stock here and there. Especially when market is tanked

- We use Acorns for money that we don’t even pay attention to. This is the platform that automatically invest your spare change

- We use Betterment for everything else. I like this platform because I can trust that when we withdraw money for some big puchases, its tax loss harvesting will minimize our tax responsiblity.

- We are keeping TD-Ameritrade cause we don’t want to sell anything to cause tax responsibility and it did the best this year because we bet on Tesla while ago ;)

- Lastly, we use Personal Capital to keep track of all the accounts. It is super powerful and easy to use. I said good-bye to mint many years ago

- You can view your net worth, cash flow, portfolio balance, debt-paydown up to one year

- Retireuemnt tools to guestimate when you can retire and projection of monthly income

- and more!

*Tax-loss harvesting: The selling of securities at a loss to offset a capital gains tax liability

**Rebalancing: a process of realigning the weightings of a portfolio of assets.

Cheers!

Reference:

- https://www.macrotrends.net/2324/sp-500-historical-chart-data

- https://www.macrotrends.net/2526/sp-500-historical-annual-returns